Refinancing student loans is the process of obtaining a new private loan at a new interest rate. The lender essentially pays off your previous debt, whether federal or private, and rolls all the debt into a new loan.

Refinancing can simplify multiple loans into one payment and secure you a better interest rate—two big advantages.

However, eligibility guidelines are strict. Lenders look at three key factors when making their decision: credit score, income, and debt-to-income ratio.

Eight million people are eligible for refinancing student loan debt. See if you’re one of them!

What credit score do you need to refinance student loans?

The higher the score, the better your chances of qualifying for student loan refinancing, and at a good interest rate. This minimum score differs from lender to lender, but 650–680 is common.

If you have poor credit, you can still refinance student loans, but you might have to wait until you can pay down some debt and bump up your score to a manageable level to get a better interest rate.

You could also enlist the help of a cosigner. (Just keep in mind that missed payments will not only affect your credit score but your cosigner’s as well.) Should your credit improve down the road, some lenders offer a cosigner release, which would allow you to remove your cosigner from the loan and take it on independently.

If your score is on the lower side — high enough to qualify but less than 700 — banks will sometimes approve your loan at a higher interest rate.

Pro tip! If you don’t know what your credit score is, you are entitled to one free copy of your credit report annually. If you know your score is going to be too low to qualify, a pointless inquiry on your report is the last thing you need.

What are the income requirements for refinancing student loans?

Lenders will need to make sure your income is steady before agreeing to refinance your student loans. To banks, unsteady sources of income can mean potentially unreliable monthly payments. Steady income tends to be predictable (such as receiving a biweekly paycheck), while unsteady income is often sporadic.

If you have a less-than-ideal credit score, a higher income can help offset a lender’s concerns. The higher the income, the lower the debt-to-income ratio, which is a factor lenders consider.

How is debt-to-income ratio used to determine eligibility?

The lower your debt-to-income (DTI) ratio, the better. Typically, lenders look for a DTI ratio of 50 percent or less.

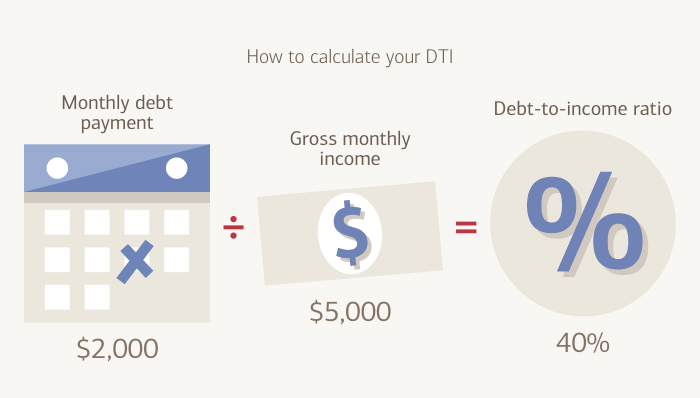

Your DTI ratio is calculated by dividing your total monthly debt obligations by your gross monthly income and multiplying that result by 100. Lenders use the resulting percentage to determine how well you manage debt. You can calculate your DTI here.

For example, if your total monthly debt payment is $2,000 and your monthly income is $5,000, your DTI is $2,000 ÷ $5,000 x 100, or 40 percent.

If you have a high DTI ratio, you can adjust it by either decreasing debt or increasing income. Paying even a small extra amount on your debt each month can have a big impact on DTI ratio down the road.

Can you refinance student loans before you graduate?

Being in school can impact eligibility because you likely don’t have a stable-enough income to qualify for student loan refinancing. So even if your credit is OK, approval or a lower interest rate are still unlikely, and you might be better off exploring other options.

The bottom line

When your credit is close to or over 700, your income is steady, and your debt-to-income ratio is less than 50 percent, you likely meet the eligibility requirements for refinancing student loan debt. Be sure to shop around for lower interest rates and get quotes from multiple lenders before making a decision!